Those individuals will be able to access your HSBC Mobile Banking App on the same device and their transactions will be considered authorized by you. If you choose to enable fingerprint scanning on a mobile device used to log on to HSBC Mobile Banking, you should not allow anyone else's fingerprints to access your mobile device.

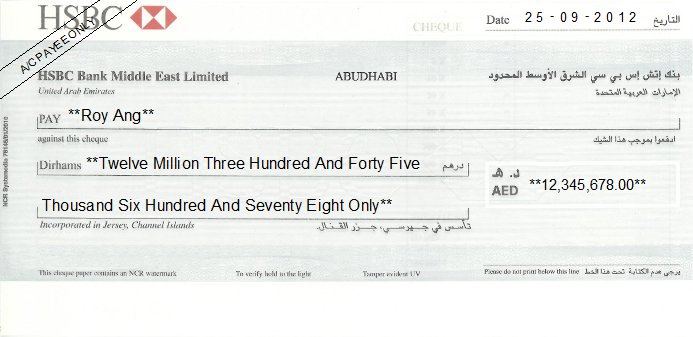

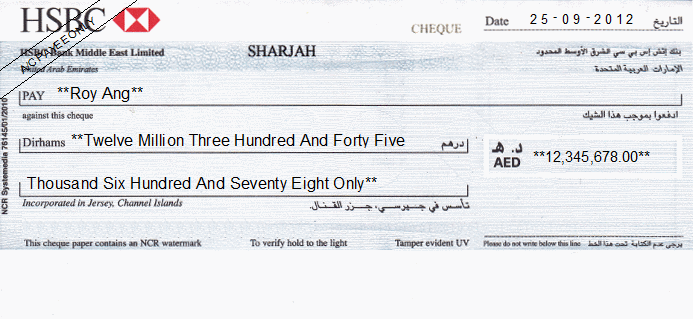

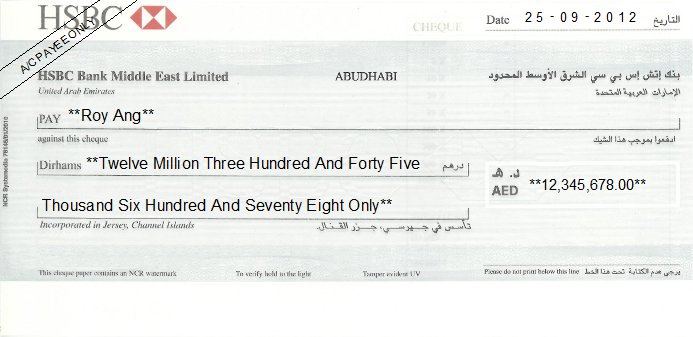

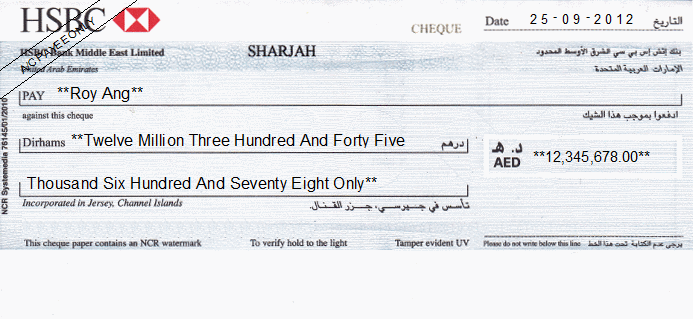

Transactions initiated by individuals with whom you share Passwords or other log on credentials to access account data or funds will be considered authorized by you. You do not take steps to safeguard your account, personal firewalls and online security diligence outlined in the HSBC Security & Fraud Center. #HSBC CHEQUEBOOK PASSWORD#

You do not report a lost or stolen Password or PIN within two business days (you may be responsible for up to $500 from date of loss to date of reporting loss). You do not inform HSBC of the fraudulent use of your online accounts within 60 days after the statement date on the account in question. Business or commercial accounts, accounts at other financial institutions or accounts not covered by the Federal Regulation E requirement. The following are not covered under HSBC's $0 Liability, Online Guarantee: Through the $0 Liability, Online Guarantee, we pledge that you will not be liable for any unauthorized online bill payments and funds transfers on HSBC accounts made through Personal Internet Banking or unauthorized online use of your HSBC credit card. What is HSBC's $0 Liability, Online Guarantee? Bank online with confidence – we've got you covered. Securely communicate with our Customer Relationship Center anytime for information on products and servicesĪll this is backed by our $0 Liability, Online Guarantee against unauthorized access. Access to Credit Card Rewards Program website to view and redeem Credit Card Rewards Points. Request a Stop Payment for an HSBC check. Apply for HSBC select accounts and services.  View your investment and brokerage balances.

View your investment and brokerage balances.  Obtain quotes for several insurance products. View information about your mortgage account including escrow and payment history. or internationally through Personal Internet Banking. Initiate wire transfer requests to another person, business or financial institution in the U.S. With the Bank to Bank Transfers service, you can move money between your HSBC accounts and other financial institutions, credit unions and brokerage accounts. Transfer funds between your HSBC accounts (this is an ideal way to pay your HSBC accounts quickly). Online Check Images - Personal Internet Banking customers with a checking account who are enrolled in the RecordCheck®service can view and print their posted checks images right online. View your eligible Checking, Savings, Select Credit and Credit Card account statements through eStatements.

Obtain quotes for several insurance products. View information about your mortgage account including escrow and payment history. or internationally through Personal Internet Banking. Initiate wire transfer requests to another person, business or financial institution in the U.S. With the Bank to Bank Transfers service, you can move money between your HSBC accounts and other financial institutions, credit unions and brokerage accounts. Transfer funds between your HSBC accounts (this is an ideal way to pay your HSBC accounts quickly). Online Check Images - Personal Internet Banking customers with a checking account who are enrolled in the RecordCheck®service can view and print their posted checks images right online. View your eligible Checking, Savings, Select Credit and Credit Card account statements through eStatements.  Review the last 16 months of transactions for Personal Internet Banking. Pay bills to virtually anyone in the United States with complimentary online Bill Pay service. View balances and transactions on your deposits, loans, credit card, and mortgage accounts. Personal Internet Banking allows you to make transactions online and manage your accounts, balances, bill payments and deposits:

Review the last 16 months of transactions for Personal Internet Banking. Pay bills to virtually anyone in the United States with complimentary online Bill Pay service. View balances and transactions on your deposits, loans, credit card, and mortgage accounts. Personal Internet Banking allows you to make transactions online and manage your accounts, balances, bill payments and deposits:

0 kommentar(er)

0 kommentar(er)